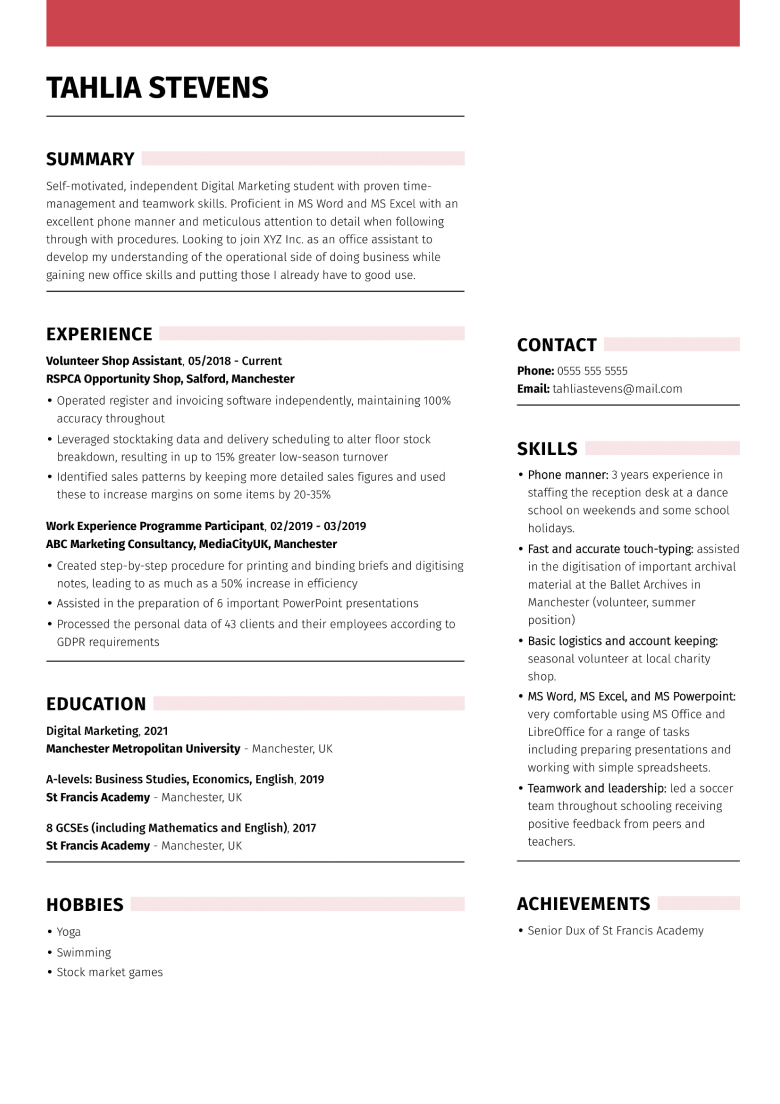

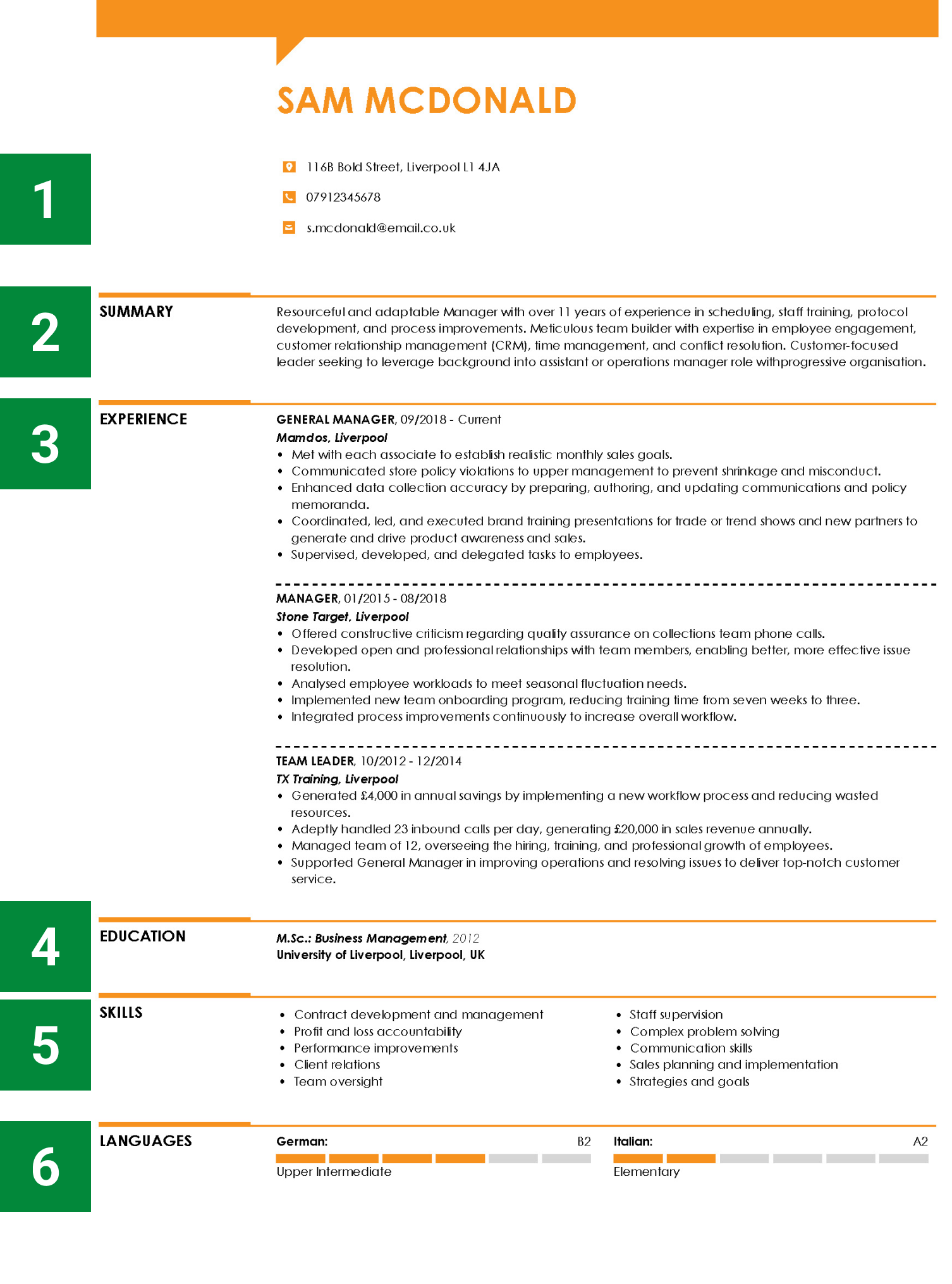

How to create a CV based on examples?

First of all, don’t do mindless copypasta. Our CV examples have been carefully crafted by certified CV writers but, at the end of the day, they’re examples. You should use them as a point of reference while tailoring every CV you send—it’s the single most effective job-hunting strategy.

Make sure your experience, skills, and personal profile match the requirements from the job ad. Also, make sure to add the right keywords. You guessed it, the ones that are used in the job ad. If you need help, check our comprehensive guide on how to write a CV.

Our CV maker comes with ready-made content for every CV section, so with little adjustments and tweaks, you can have a job-winning CV ready in minutes.

Create your cv now