How to Write an Academic CV (Template & Example)

Writing an academic CV requires a focus on showcasing your academic and professional accomplishments. Here's a step-by-step guide on how to create it to continue your research.

November 7, 2025

Last updated on 19 December, 2025

It sometimes seems that most people who get into finance and especially accounting are ‘straight-shooters’: people who prefer short, direct communication without a lot of flowery prose and padding.

Do you write unnecessarily long emails with far too much description and too many digressions? It’s unlikely that you do. That’s why accountants especially tend to get so stuck when sitting down to write or overhaul their accountant CV.

Writing a good accounting CV doesn’t involve any waffling or padding. Read on to see an accounting CV example for the UK that’s better than most out there and learn how to make yours at least as good.

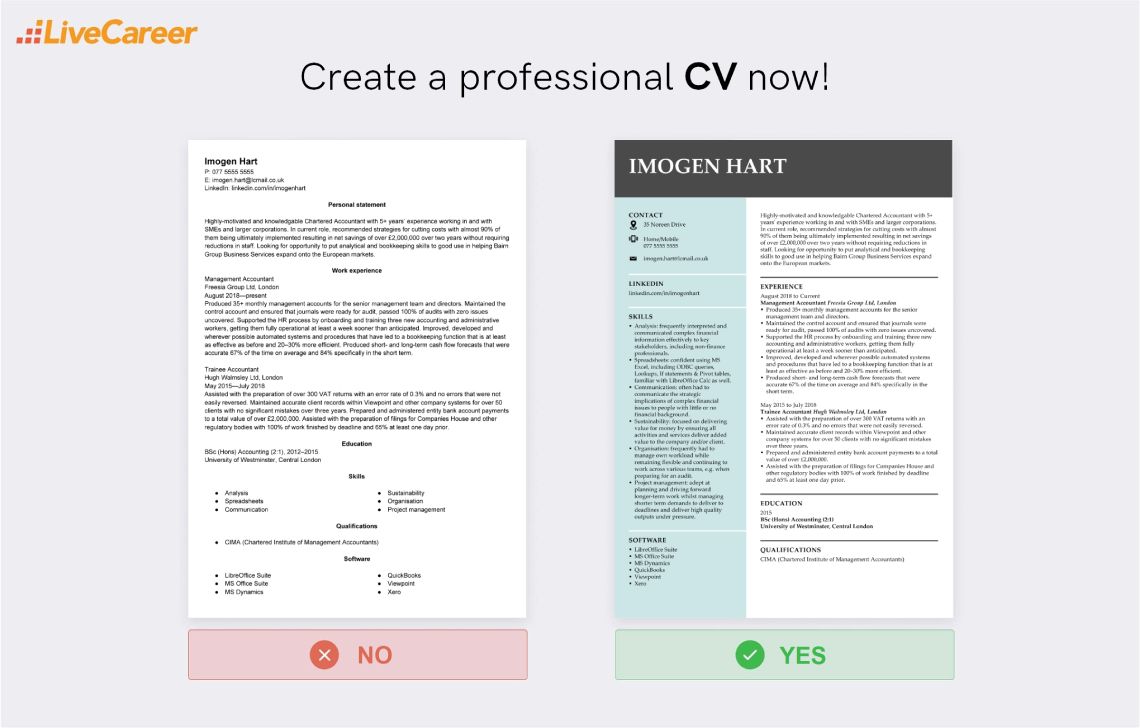

Create an effective CV in minutes. Choose a professional CV template and fill in every section of your CV in a flash using ready-made content and expert tips.

We created the sample on the right using our builder. See other good CV examples like this one.

Looking for other CV examples? See our guides for:

Haven't found what you're looking for? See all our CV examples.

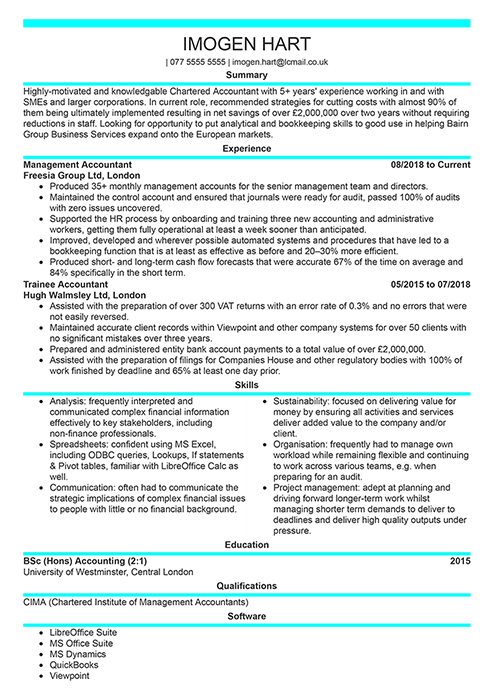

Imogen Hart

P: 077 5555 5555

E: imogen.hart@lcmail.co.uk

LinkedIn: linkedin.com/in/imogenhart

Personal statement

Highly-motivated and knowledgable Chartered Accountant with 5+ years’ experience working in and with SMEs and larger corporations. In current role, recommended strategies for cutting costs with almost 90% of them being ultimately implemented resulting in net savings of over £2,000,000 over two years without requiring reductions in staff. Looking for opportunity to put analytical and bookkeeping skills to good use in helping Bairn Group Business Services expand onto the European markets.

Work experience

Management Accountant

Freesia Group Ltd, London

August 2018—present

Trainee Accountant

Hugh Walmsley Ltd, London

May 2015—July 2018

Education

BSc (Hons) Accounting (2:1), 2012–2015

University of Westminster, Central London

Skills

Qualifications

Software

Now, here’s how to write an accountant CV example:

Writing a CV personal statement (also called a CV profile) for an accounting job application can be a daunting task—if nothing else, it’s the longest chunk of text in your accounting CV and the most ‘free-form’. Plus, this is where you’ll make your first impression with your CV. You have one short paragraph to do three things:

You’ll also have to write a new personal statement for each and every new job application. Luckily, there’s an extremely effective shortcut to generating accounting personal statement after accounting personal statement. Simply answer each of these questions in a total of 3–4 sentences, 50–150 words:

Your accountant CV is very likely to be parsed by an Applicant Tracking System before a human being even lays eyes on it, and there are a couple of things you can do to boost your chances of getting through:

Your accounting personal statement clearly goes first in your CV, but it’s best to write it last. It’ll be much easier for you to do a good job once you have your job descriptions written and some practice in writing achievements under your belt (it's basically a CV summary).

And, one more thing to be noted. If you're writing a part qualified accountant CV with limited experience, you might want to incorporate CV objective to convey your aspirations and goals.

Highly motivated and knowledgable Chartered Accountant with 5+ years’ experience working in and with SMEs and larger corporations. Recommended methods and strategies for cutting costs in current role as management accountant, with almost 90% of them being ultimately implemented resulting in net savings of over £2,000,000 over two years without requiring reductions in staff. Looking for opportunity to put analytical and bookkeeping skills to good use in helping Bairn Group Business Services expand onto the European markets.

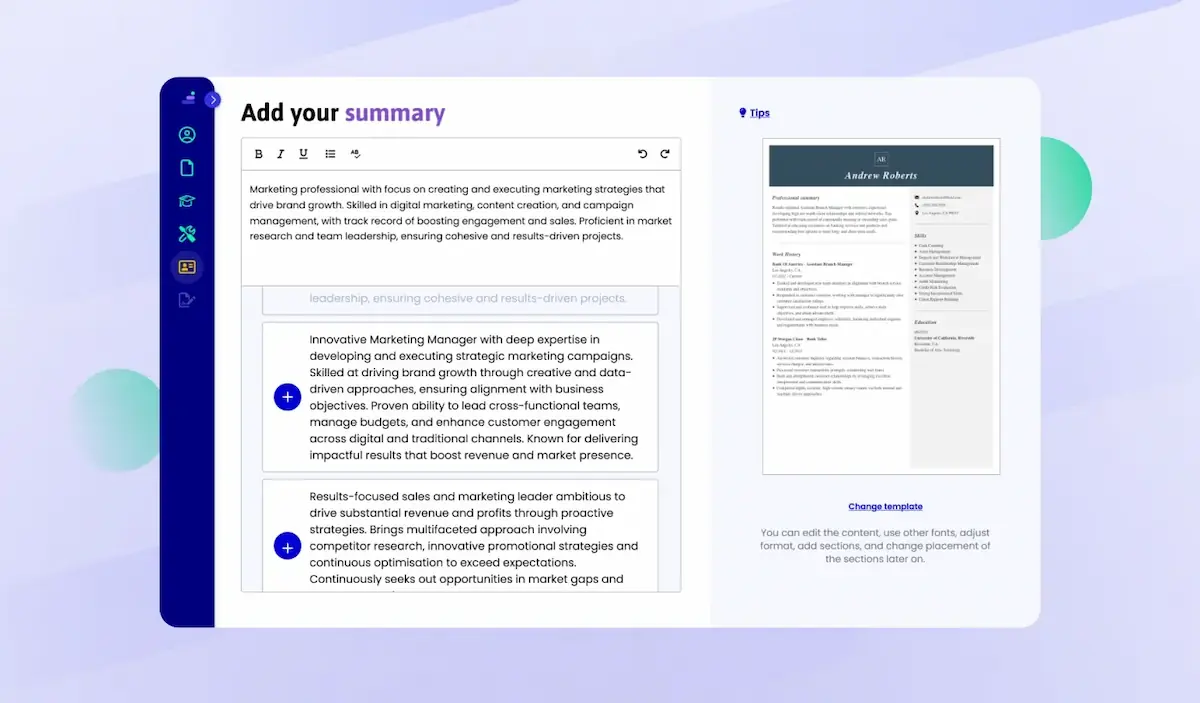

A strong CV summary will convince the recruiter you’re the perfect candidate. Save time and choose a ready-made personal statement written by career experts and adjust it to your needs in the LiveCareer CV builder.

What makes a good CV? For an accounting CV, the work experience section is often the most crucial part. It’s also your best opportunity to put your accounting skills to use in writing your CV. First things first, use a chronological format for your CV, starting from your most recent experience and working your way back from there.

This is what hiring managers are expecting to see in an accounting CV and it’s also more easily parsed by an ATS. You’ll then need to create a subheading for each job description. Use this template to help you:

[Job Title]

[Company Name, Location]

[Dates of Employment]

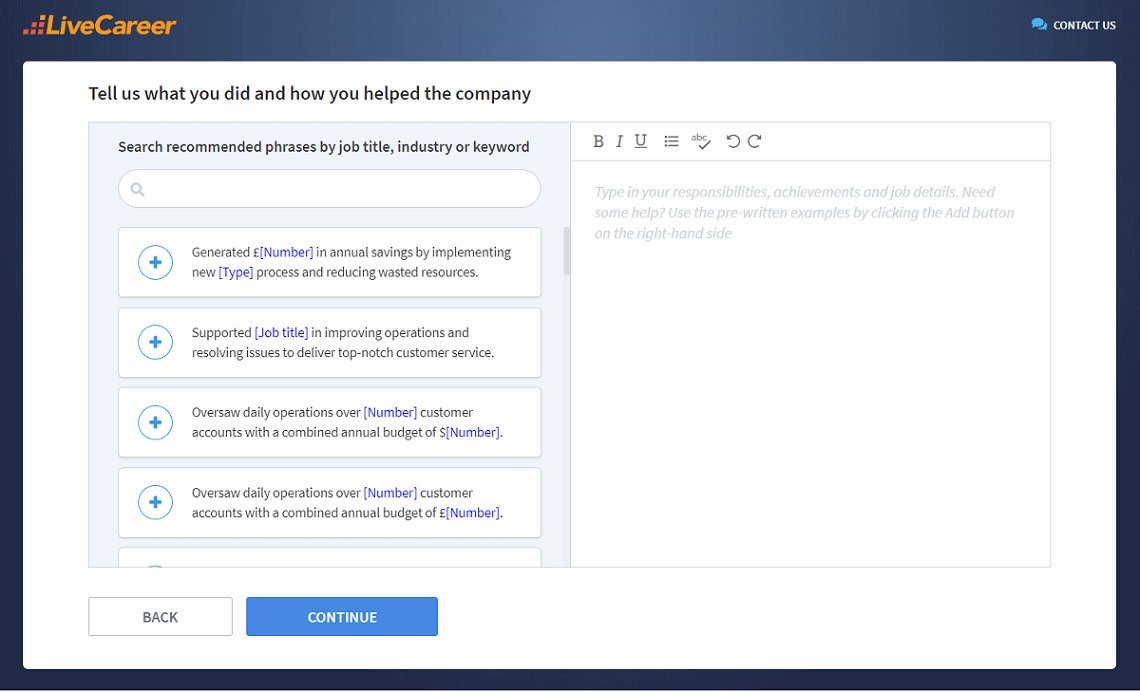

Now you’ll need to fill each job description with up to six bullet points. These bullet points will not be your duties or responsibilities. Instead, they’ll be your measurable and quantified accounting achievements. You can use accomplishment statements to help you write these achievements out consistently.

The main thing to remember is that an achievement is basically a description of an action you took and the benefits that your action brought to the company. So start each achievement with a strong verb (like created, improved, reduced, etc.) and quantify everything you can, even if you have to estimate.

If you’re writing something like a trainee accountant CV or accounting assistant CV with no experience, then follow the above guidelines but focus on any internships, placement work, and volunteer work you’ve done. If you're crafting a part qualified accountant CV or have no experience at all, then consider a student CV instead. See how to write your first CV.

Management Accountant

Freesia Group Ltd, London

August 2018—present

Trainee Accountant

Hugh Walmsley Ltd, London

May 2015—July 2018

Whether you choose to get into private practice or public finance, university is certainly not the only road into accountancy. Nevertheless, your education, training and qualification level obviously matter, so make your education section as clear and easy to follow as possible.

Stick with a reverse-chronological order so that your highest education reached will be first. If you have a university degree, then there’s no need to mention high school. There’s no need to mention grades no matter what—they’ll only add clutter without adding any value.

Use the following template for university degrees as well as other tertiary qualifications:

[Degree Type] [Degree Name](Degree Class), [Years Attended]

[Institution Name], [Institution Location]

If you’re still studying, then include an expected graduation date. If you don’t have a university degree, CFAB or AAT, then use the following templates to describe your high school education:

A-levels: [Subject Name 1], [Subject Name 2], [Subject Name 3]

[School Name], [School Location], [Years Attended]

[n] GCSEs (including Mathematics and English)

[School Name], [School Location], [Years Attended]

where n is the number of GCSEs you completed.

If you’re writing a graduate accountant CV or junior accountant CV and don’t have much experience yet, then put this section above your work experience section.

BSc (Hons) Accounting (2:1), 2012–2015

University of Westminster, Central London

Just as there are many fields in accounting so are there many different skill-sets in accounting. Make it clear to your recruiters exactly what skills you bring to the table. Start by making a master list of accounting skills and backing each skill up with some supporting evidence.

To do this, open a separate document and brainstorm as many of your accounting skills as you can (hard and communication skills). Once you’re done, go back and add a sentence to each skill you’ve listed that demonstrates that you’ve actually put this skill into action in your accounting work. If you can’t do this for a skill, then it’s out.

This file is your master list for future applications. Go back to your accountant CV and the job advert to which you’re responding. Copy 5–10 accounting skills from your master list into your accounting CV, being sure to at least cover what’s asked for in the advert. Substitute synonyms to mirror keywords from the advert.

Based on over 6 million CVs created in our builder, we found out that*:

*The data comes from a period of 12 months (August 2023-August 2024).

It’s easy to get pigeonholed as an accountant. Stretch the mould to fit your professional self by adding extra sections to your accounting CV. You could add sections that list your additional qualifications (e.g. ACCA, CIMA, ACA, CIFPA, ICAS, ICAEW, as well as CFAB and AAT) or software proficiencies, for example.

Your additional CV sections needn’t be so directly relevant to your role, though. You could, for example, include any foreign languages you speak (a boon in virtually any industry) or even your hobbies. These sections have to be relevant to your application but that doesn’t mean always sticking to the obvious.

Qualifications

Software

You’re no stranger to forms, applications and reports coming in two or more parts. Your accounting CV is no different—it’s just one part of your job application, and your accountant cover letter is the other part. Always include a cover letter unless you’ve been explicitly asked not to do so. Such a document can prove especially advantageous when crafting an entry level accountant CV or a part-qualified accountant CV. It will help to communicate your motivation, enthusiasm and eagerness to develop your skills in the accounting field.

A good accounting cover letter will follow the standard UK business letter format. It, like your accounting CV, will be based around quantified achievements. The structure should end up looking something like this:

In terms of cover letter length, your body paragraphs should look something like this:

This should leave your whole accounting cover letter between 250 and 400 words long, which is between half an A4 page and a single A4 page. Daunting at first but much simpler than it seems. You’re easily halfway there once you have the work experience section of your CV written.

Here are a few CV layout rules to remember about when writing your accounting CV example in the UK.

A typo or spelling or grammatical error in your accounting CV or cover letter is like a miscalculation in a statement of financial position—something to be avoided at all costs. Get someone else to look over your work and use any of the apps, web apps, or programmes out there that can help you.

What should a good CV look like? You don’t need a lecture on the importance of legible, reader-friendly layout. So just remember to leave your contact details near the top of your CV and don’t skimp on white space throughout. Keep everything as easy to scan through as possible. View free CV templates & our top template picks to find the ideal one. Use a CV font like Noto, Garamond, Arial, or whatever your default is. Make your sections headings slightly larger. You can also use bold or underline to guide the recruiter’s eyes.

Send your documents through as PDF files unless explicitly asked for something else. PDFs will preserve your formatting much better than most other formats.

Haven’t heard back after a week? Follow up with a quick email or phone call. It can’t hurt and may even do a lot of good. At the very least, you’ll know where your application stands.

You don’t have to be a CV writing expert. In the LiveCareer CV builder you’ll find ready-made content for every industry and position, which you can then add with a single click.

Has this article helped you massage your accountant CV into shape? I hope so—please leave a comment below if there’s anything I touched upon that you’d like me to elaborate on. Leave any other comments, questions, feedback or experiences you’d like to share below as well—we’d love to read them.

*Data was collected from July 2023 to June 2024.

Our editorial team has reviewed this article for compliance with LiveCareer’s editorial guidelines. It’s to ensure that our expert advice and recommendations are consistent across all our career guides and align with current CV and cover letter writing standards and trends. We’re trusted by over 10 million job seekers, supporting them on their way to finding their dream job. Each article is preceded by research and scrutiny to ensure our content responds to current market trends and demand.

Category: CV Examples

Crafting a job-winning CV is all about showcasing your unique skills and experiences. Start with a strong personal statement that highlights your career goals and achievements.

Try Our CV Builder Now