Create a professional CV now!

NO

NO YES

YESLast updated on 14 January, 2026

Our customers have been hired by*:

Can you be both self-employed and working for an employer? The short answer: yes. Many people hold down a regular job while freelancing on the side, or run their own business while still working closely with a single client. I’ll explain how that arrangement works, the everyday situations where it comes up, and some practical things to keep in mind. Let’s begin!

Create an effective CV in minutes. Choose a professional CV template and fill in every section of your CV in a flash using ready-made content and expert tips.

Create a professional CV now!

NO

NO YES

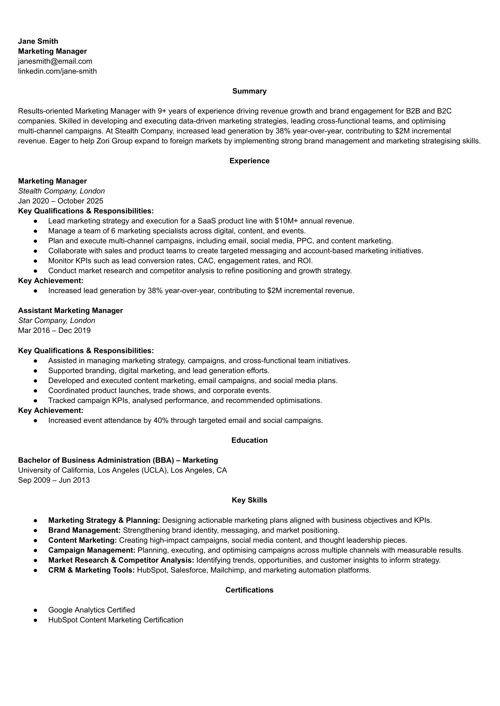

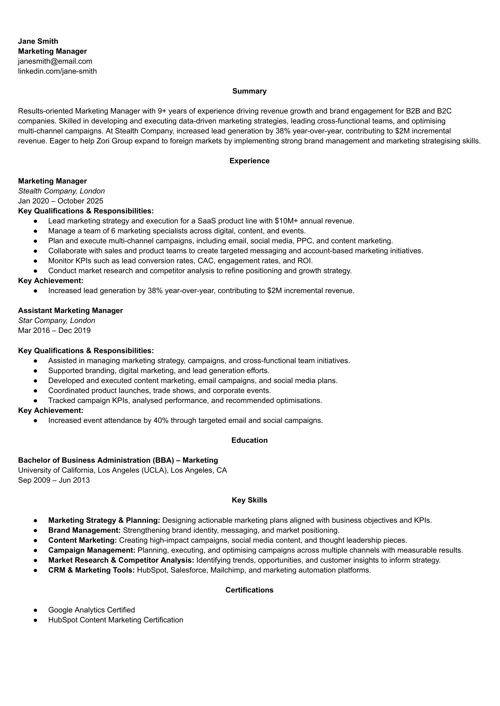

YESWe created the sample on the right using our builder. See other good CV examples like this one.

Would you like to read about related topics? Check out the articles below:

Before deciding whether to combine statuses, it is helpful to be clear about what each one actually means in practice. These definitions determine your legal rights, how you get paid and who handles tax and National Insurance.

If you’re employed (PAYE), you usually:

If you’re self-employed (sole trader/contractor/freelancer), you typically:

There are a few everyday situations that produce this setup, and it’s helpful to recognise which one applies to you. Each scenario presents its own set of practical and legal considerations.

Many people hold a salaried job while running a small business or freelancing in their free time, such as evenings and weekends (for example, tutoring, design, or dog walking). That’s usually straightforward, but you should check your employment contract for any restrictions on outside work and side hustles.

Sometimes contractors provide the bulk of their time to a single organisation. That can create a grey area around employment status, but it’s still possible to remain genuinely self-employed if the relationship is structured as a commercial one.

Misclassification can cause serious problems for both you and the engager. Signs of false self-employment include:

If HMRC reclassifies the relationship, it can lead to back taxes, NICs and penalties, so get your status right from the start.

Contracts often decide outcomes long before disputes arise, so read them closely. This short chapter explains the practical clauses to look out for and why they matter.

Check these elements in any contract:

If you’re mixing employed and self-employed income, there’s additional administrative work involved. You’ll need to:

Recent ONS figures show around 1.35 million people hold a second job – a record level. That trend helps explain why many workers combine PAYE work with self-employed activity: for extra income, flexibility, or to test a business idea.

In 2024, there were over 4 million self-employed people in the UK. To determine if this is a path for you, it’s beneficial to weigh the pros and cons. Weighing up advantages and drawbacks helps you decide whether juggling both makes sense.

Here are the main advantages of being both self-employed and working for an employer:

Although many people like being both self-employed and employed, such a combo has its own disadvantages:

If you’re both employed and self-employed, it’s usually best to mention your self-employment on your CV, especially if the experience is relevant to your target role. Even if you have a regular job, your business work can demonstrate valuable skills like initiative, project management, and client communication.

Here’s how to present self-employment on a CV:

In short: Yes, mention self-employment on your CV, but keep it concise, relevant, and framed as an asset. It’s an excellent opportunity to demonstrate independence and versatility without raising red flags about your commitment.

Being self-employed but working for an employer is common and often a smart move, but the detail matters. Check your contracts, stay on top of tax and NI, log everything and get specialist help if IR35 or complex contracting is involved.

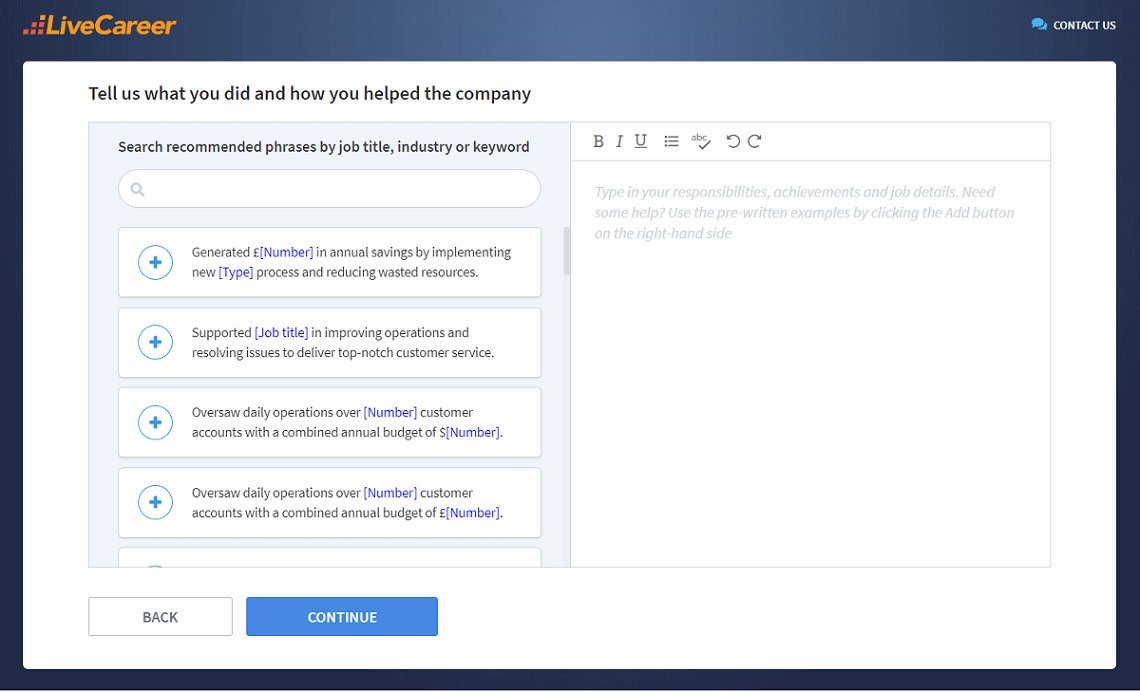

You don’t have to be a CV writing expert. In the LiveCareer CV builder you’ll find ready-made content for every industry and position, which you can then add with a single click.

Thank you for reading my article on being self-employed while working for an employer. If you’re looking for more career advice, I’d like to invite you to take a look at other articles on our blog. I’m sure they’ll provide you with lots of valuable tips!

Our editorial team has reviewed this article for compliance with LiveCareer’s editorial guidelines. It’s to ensure that our expert advice and recommendations are consistent across all our career guides and align with current CV and cover letter writing standards and trends. We’re trusted by over 10 million job seekers, supporting them on their way to finding their dream job. Each article is preceded by research and scrutiny to ensure our content responds to current market trends and demand.

Category: Career Advice

Crafting a job-winning CV is all about showcasing your unique skills and experiences. Start with a strong personal statement that highlights your career goals and achievements.

Try Our CV Builder Now