Investment Banking CV: Template & How to Write (Examples)

Our customers were hired by:

As an investment banker, you’re familiar with many aspects of doing business in an investment bank or boutique. You often work across departments and business functions. Acquisitions, IPOs, M&As, accounting, legal, PR, the list goes on. Why then is it so difficult to coble together a decent CV?

Your job requires you to be a great communicator and as a communicator, you rightly feel the need to know your audience before you can persuade them. The problem is that the HR and hiring side of things is probably quite foreign to you at your current job, let alone the companies to which you’re applying.

This article has done the prep work for you. It’ll show you the data-driven approach that’s proven itself effective with HR gatekeepers. Read on for an example of a truly effective UK investment banking CV as well as plenty of advice and examples to help get yours to at least the same level.

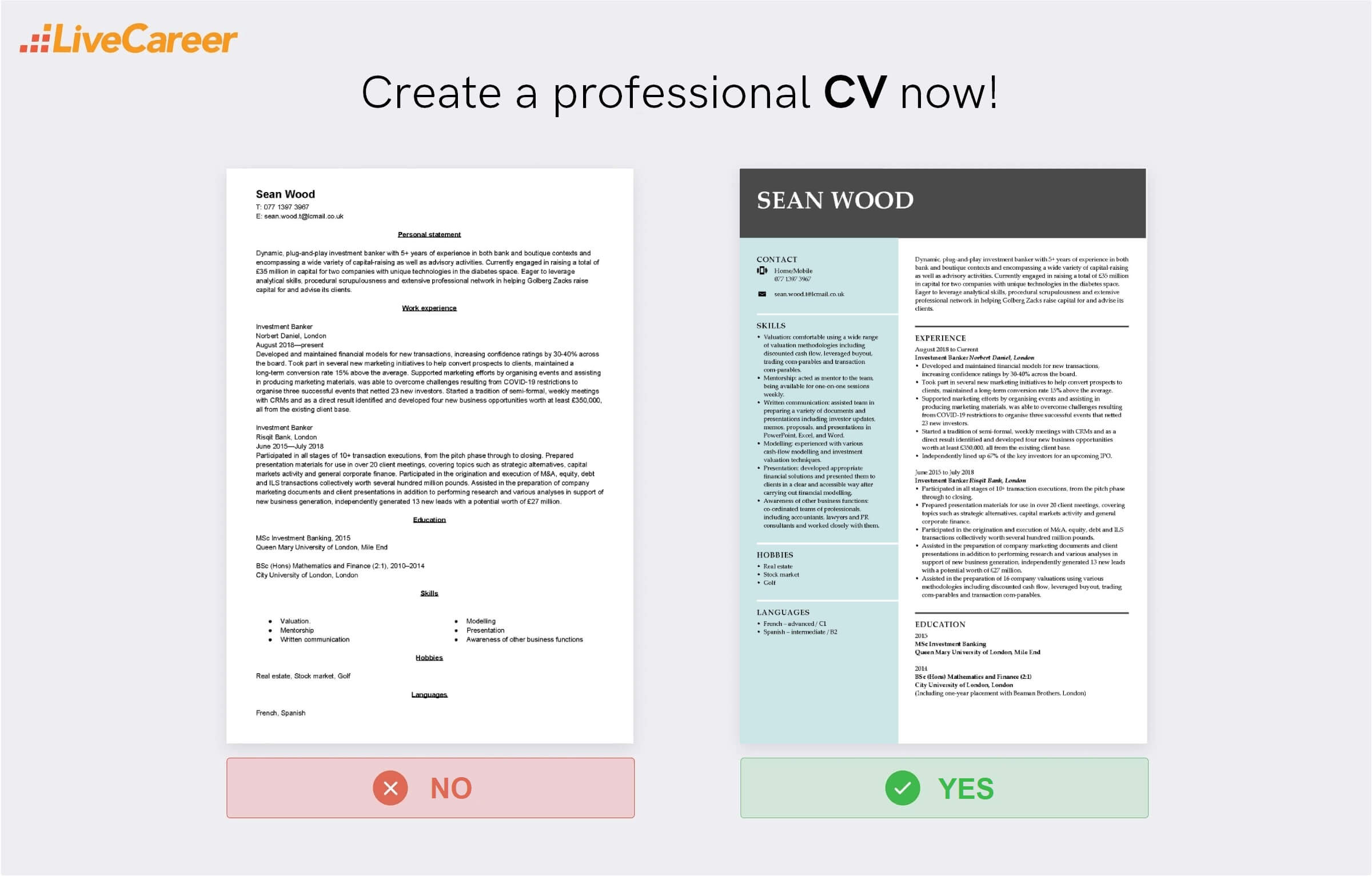

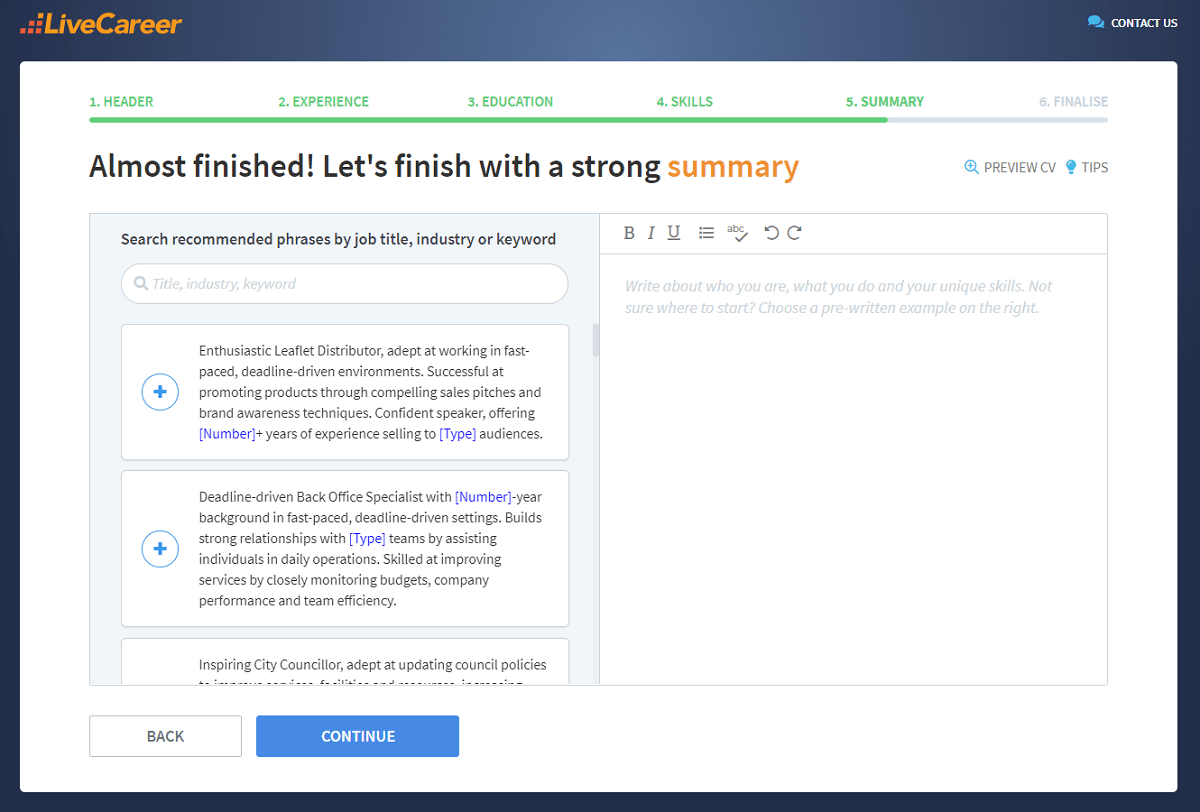

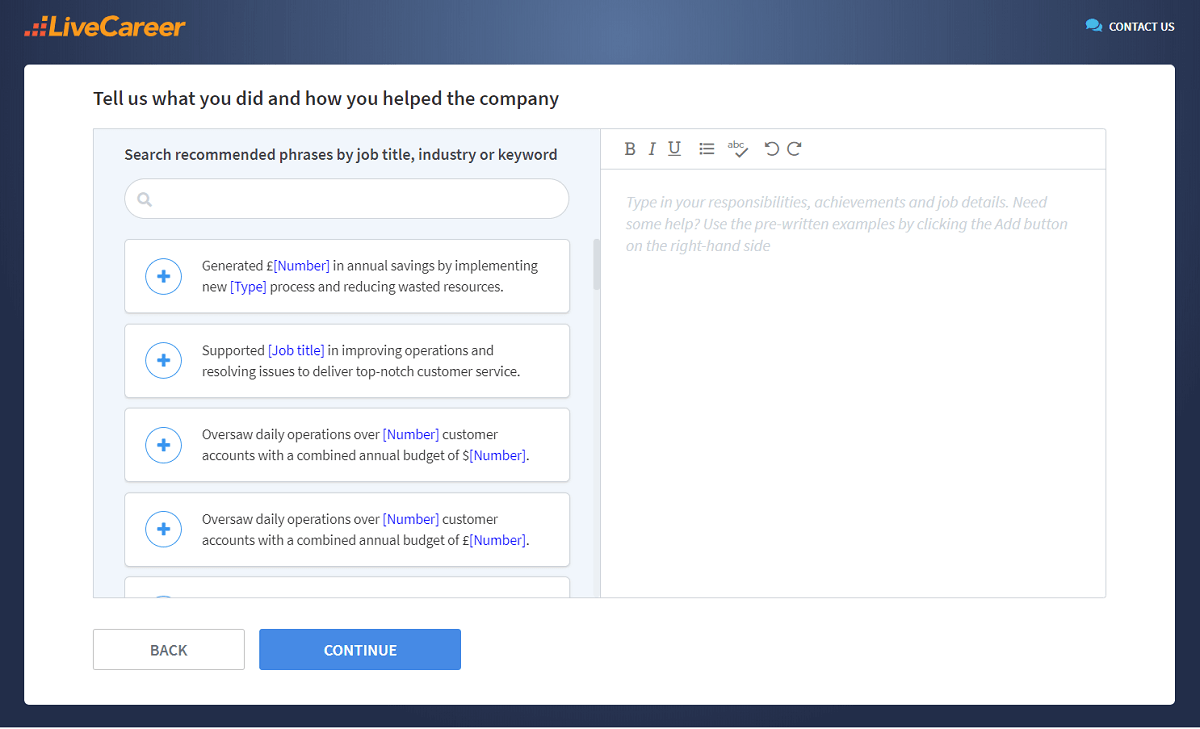

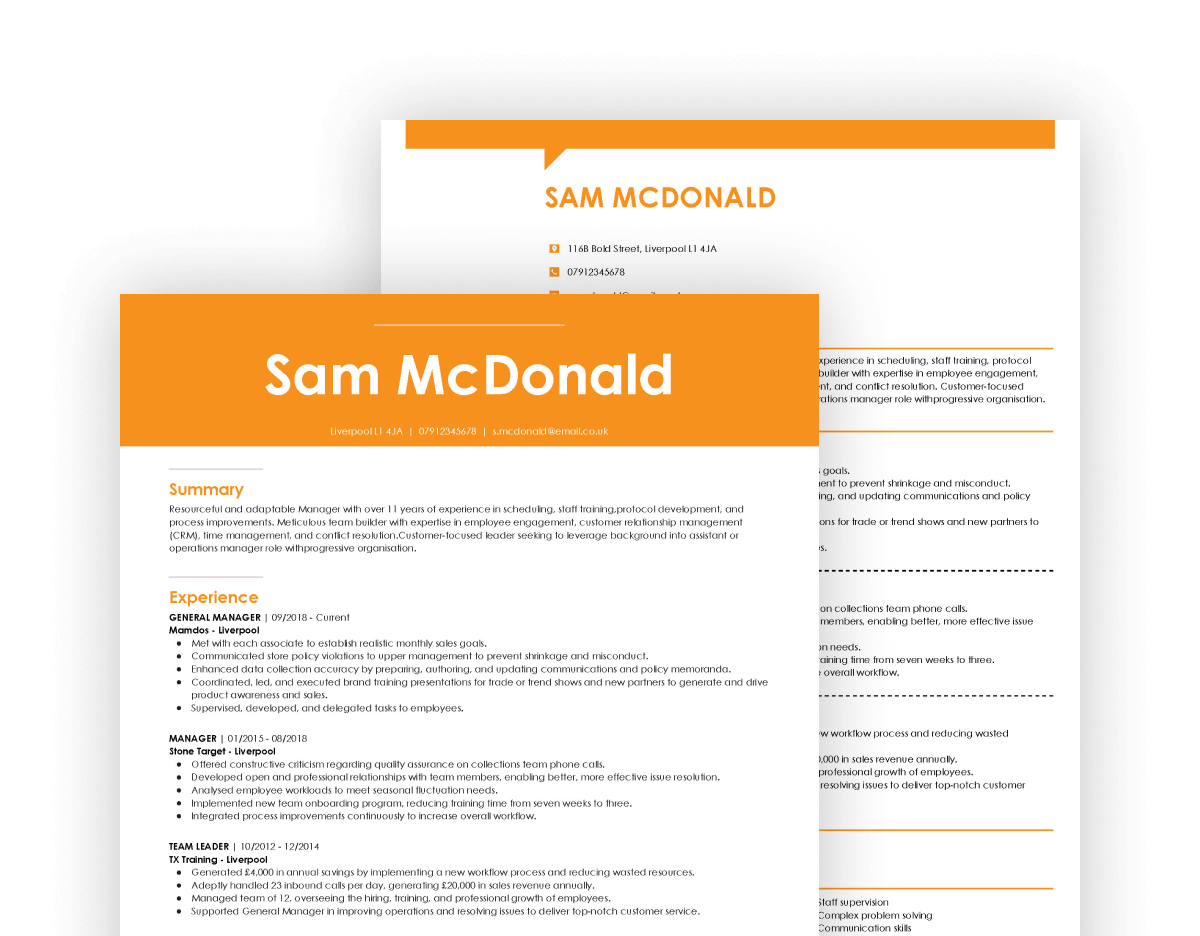

Create an effective CV in minutes. Choose a professional CV template and fill in every section of your CV in a flash using ready-made content and expert tips.

The LiveCareer online CV maker lets you build a professional CV fast and download it as a PDF or DOC.

Need a different CV example? Check these guides:

Haven't found what you're looking for? Check all our CV examples.

Investment banking CV template

Sean Wood

T: 077 1397 3967

E: sean.wood.t@lcmail.co.uk

LinkedIn: linkedin.com/in/seantwood

Personal statement

Dynamic, plug-and-play investment banker with 5+ years of experience in both bank and boutique contexts and encompassing a wide variety of capital-raising as well as advisory activities. Currently engaged in raising a total of £35 million in capital for two companies with unique technologies in the diabetes space. Eager to leverage analytical skills, procedural scrupulousness and extensive professional network in helping Golberg Zacks raise capital for and advise its clients.

Work experience

Investment Banker

Norbert Daniel, London

August 2018—present

- Developed and maintained financial models for new transactions, increasing confidence ratings by 30-40% across the board.

- Took part in several new marketing initiatives to help convert prospects to clients, maintained a long-term conversion rate 15% above the average.

- Supported marketing efforts by organising events and assisting in producing marketing materials, was able to overcome challenges resulting from COVID-19 restrictions to organise three successful events that netted 23 new investors.

- Started a tradition of semi-formal, weekly meetings with CRMs and as a direct result identified and developed four new business opportunities worth at least £350,000, all from the existing client base.

- Independently lined up 67% of the key investors for an upcoming IPO.

Investment Banker

Risqit Bank, London

June 2015—July 2018

- Participated in all stages of 10+ transaction executions, from the pitch phase through to closing.

- Prepared presentation materials for use in over 20 client meetings, covering topics such as strategic alternatives, capital markets activity and general corporate finance.

- Participated in the origination and execution of M&A, equity, debt and ILS transactions collectively worth several hundred million pounds.

- Assisted in the preparation of company marketing documents and client presentations in addition to performing research and various analyses in support of new business generation, independently generated 13 new leads with a potential worth of £27 million.

- Assisted in the preparation of 16 company valuations using various methodologies including discounted cash flow, leveraged buyout, trading com-parables and transaction com-parables.

Education

MSc Investment Banking, 2015

Queen Mary University of London, Mile End

BSc (Hons) Mathematics and Finance (2:1), 2010–2014

City University of London, London

(Including one-year placement with Beaman Brothers, London)

Skills

- Valuation: comfortable using a wide range of valuation methodologies including discounted cash flow, leveraged buyout, trading com-parables and transaction com-parables.

- Mentorship: acted as mentor to the team, being available for one-on-one sessions weekly.

- Written communication: assisted team in preparing a variety of documents and presentations including investor updates, memos, proposals, and presentations in PowerPoint, Excel, and Word.

- Modelling: experienced with various cash-flow modelling and investment valuation techniques.

- Presentation: developed appropriate financial solutions and presented them to clients in a clear and accessible way after carrying out financial modelling.

- Awareness of other business functions: co-ordinated teams of professionals, including accountants, lawyers and PR consultants and worked closely with them.

Hobbies

- Real estate

- Stock market

- Golf

Languages

- French – advanced / C1

- Spanish – intermediate / B2

Now you know what to put in a CV. Here's how to lay out a professional CV step by step.

1. Start your investment banking CV with a personal statement

Start writing your CV with a personal statement. Like a firm handshake and proffered business card, your personal statement constitutes a first impression of you as a banker. A good CV personal profile does three things:

- introduces you as a banker

- shows what you have to offer

- shows that your goals line up with the company’s goals

You’ll be writing a new personal statement for each new job application. To streamline the process, simply answer the questions below using a total of 3–4 sentences and 50–150 words:

- What kind of investment banker are you?

- How many years of experience do you have and in which contexts?

- What’s your most impressive and relevant achievement?

- What’s your most unique CV achievement? (Optional)

- What are you hoping to be able to achieve in this job? (For your employer, not yourself).

Your application might be parsed by an ATS (Applicant Tracking System) before a human being ever sets eyes on it. This is just one more reason why you should be sure to mention the position you’re applying for as well as the company name. Use keywords from the job advert as well, but don’t overdo it.

Your personal statement starts your CV, but it’s best to write it last. You’ll be able to do a much better job once you have your job descriptions and skills list prepared (and that's why it's also called a CV summary).

Investment banking CV personal statement example

Dynamic, plug-and-play investment banker with 5+ years of experience in both bank and boutique contexts and encompassing a wide variety of capital-raising as well as advisory activities. Currently engaged in raising a total of £35 million in capital for two companies with unique technologies in the diabetes space. Eager to leverage analytical skills, procedural scrupulousness and extensive professional network in helping Golberg Zacks raise capital for and advise its clients.

A strong CV summary will convince the recruiter you’re the perfect candidate. Save time and choose a ready-made personal statement written by career experts and adjust it to your needs in the LiveCareer CV builder.

2. Add a work experience section that gets results

Use a chronological format for your CV work experience section. This means starting from your most recent position and working your way back from there. This is what hiring managers are most used to and it’ll be more easily parsed by an ATS.

Use the following template to create a subheading for each job description:

[Job Title]

[Company Name, Location]

[Dates of Employment]

Populate each job description with achievements rather than duties. List up to six achievements in bullet-point form under each subheading. Quantify every bullet point. Use accomplishment statements to help structure and quantify your bullet points. Consider using something like the STAR method.

If you’re applying for an investment banking internship or an entry-level position without any experience, focus on showing transferable skills by listing any placement and volunteer work you’ve done. Add your work experience section after your education section and consider if a student or graduate CV wouldn’t be a more effective approach.

Investment banking CV job description sample

Investment Banker

Norbert Daniel, London

August 2018—present

- Developed and maintained financial models for new transactions, increasing confidence ratings by 30-40% across the board.

- Took part in several new marketing initiatives to help convert prospects to clients, maintained a long-term conversion rate 15% above the average.

- Supported marketing efforts by organising events and assisting in producing marketing materials, was able to overcome challenges resulting from COVID-19 restrictions to organise three successful events that netted 23 new investors.

- Started a tradition of semi-formal, weekly meetings with CRMs and as a direct result identified and developed four new business opportunities worth at least £350,000, all from the existing client base.

- Independently lined up 67% of the key investors for an upcoming IPO.

Investment Banker

Risqit Bank, London

June 2015—July 2018

- Participated in all stages of 10+ transaction executions, from the pitch phase through to closing.

- Prepared presentation materials for use in over 20 client meetings, covering topics such as strategic alternatives, capital markets activity and general corporate finance.

- Participated in the origination and execution of M&A, equity, debt and ILS transactions collectively worth several hundred million pounds.

- Assisted in the preparation of company marketing documents and client presentations in addition to performing research and various analyses in support of new business generation, independently generated 13 new leads with a potential worth of £27 million.

- Assisted in the preparation of 16 company valuations using various methodologies including discounted cash flow, leveraged buyout, trading com-parables and transaction com-parables.

3. Include an education section in your investment banking CV

For a perfect CV, stick with reverse-chronological order for your education section. For your university degrees, include the name and class of your degree, the years you attended (with an expected graduation date if you’re still studying), and the name of the institution and its location.

As it is rather unlikely to get an investment banker job without a higher degree, you can skip adding your high school education. But if you lack work experience, you may want to add bullet points here to highlight your achievements or areas of excellence while studying (extracurricular activities for example).

Investment banking CV education section example

MSc Investment Banking, 2015

Queen Mary University of London, Mile End

BSc (Hons) Mathematics and Finance (2:1), 2010–2014

City University of London, London

(Including one-year placement with Beaman Brothers, London)

4. Showcase your investment banking skills in your CV

The data-driven approach to your investment banking CV continues into your skills section. You’ll end up with a list of 5–10 hard and soft skills that’ll really set you apart from the competition and make recruiters sit up and take notice.

Set your CV aside for the moment and open a new document. List as many of your investment banking skills as you can. Aim for a good mix of soft, hard and IT skills. Once you’re done, add a sentence to each skill that describes how and when you’ve demonstrated that skill.

If you can’t come up with such a sentence, then that skill doesn’t make the cut. Your master list will include only skills that you can readily back up with concrete examples. Copy across 5–10 skills into your CV that match the requirements in the advert. Do this for every application, but keep the same master list.

Investment banking CV skills

- Valuation: comfortable using a wide range of valuation methodologies including discounted cash flow, leveraged buyout, trading com-parables and transaction com-parables.

- Mentorship: acted as mentor to the team, being available for one-on-one sessions weekly.

- Written communication: assisted team in preparing a variety of documents and presentations including investor updates, memos, proposals, and presentations in PowerPoint, Excel, and Word.

- Modelling: experienced with various cash-flow modelling and investment valuation techniques.

- Presentation: developed appropriate financial solutions and presented them to clients in a clear and accessible way after carrying out financial modelling.

- Awareness of other business functions: co-ordinated teams of professionals, including accountants, lawyers and PR consultants and worked closely with them.

5. Add extra sections to your investment banking CV

Don’t miss out on the opportunity to paint as full a portrait of yourself as an investment banking professional as possible—include extra sections in your CV to fill in the blank spots. This is the place to add any extra qualifications (ACA, CFA, etc.), achievements, awards, hobbies or interests.

Do you speak any languages other than English? Include a languages section if you do. Speaking a foreign language is still relatively uncommon in the UK and is a great way to stand out. It’s an especially well-received attribute in investment banking, not only because of the cognitive benefits it brings.

Save space for more relevant sections and don't list references on your CV. Recruiters know they can ask for them.

Investment banking CV additional sections sample

Hobbies

- Real estate

- Stock market

- Golf

Languages

- French – advanced / C1

- Spanish – intermediate / B2

6. Write an investment banking cover letter to go with your CV

Your investment banking job application will have two main parts: your investment banking CV and a cover letter. Most employers still expect that you’ll send your CV with a cover letter. You should definitely do so unless you’ve been explicitly asked not to.

The good news is that you’re easily halfway there to having your investment banking cover letter written if you’ve already prepared your job descriptions and skills for your investment banking CV. Like much of your CV, you should write a new cover letter for each job application, or know which sections to swap out.

Your cover letter should follow the standard British business letter format and include the following parts:

- a properly set out header

- an appropriate salutation

- a strong, attention grabbing cover letter opening

- a showcase of your professional achievements

- a solid cover letter wrap-up and CTA

- the right sign off for your particular case

How long should your cover letter be? Over half an A4 page long but no longer than one A4 page, about 200–350 words in total. It should also be well-balanced in terms of its proportions:

- opening paragraph—between 60 and 80 words

- main body—between 120 and 200 words

- closing paragraph—between 40 and 60 words.

7. What else should you keep in mind when writing your CV?

Follow these basic CV formatting rules:

- Leave your personal details near the top of your CV and set them out in a way that makes them clear and easy to find.

- Use subheadings and as much white space as possible to clearly break your CV structure down into sections.

- Choose an understated and professional-looking CV font like Arial, Noto or Garamond, or stick with whatever the default is, like Liberation or Calibri.

- Always attach your CV as a PDF file unless explicitly asked for something else.

- What about the right CV length? Keep to one page per decade of experience with a maximum of two pages.

When it comes to CV design, it's better to avoid creative CV templates. Investment banking is a conservative industry so a basic CV template will do.

Proofread and spellcheck your investment banking CV and cover letter. Get a second pair of eyes on both documents if at all possible.

And one last CV tip: follow up if you haven’t heard back after a week. A quick phone call or email is all it takes to put your mind at ease and can only put you in a positive light.

You don’t have to be a CV writing expert. In the LiveCareer CV builder you’ll find ready-made content for every industry and position, which you can then add with a single click.

I hope this article has helped you end up with an investment banking CV you can be proud of. Is there anything I’ve mentioned here that you’d like more information about? Do you have any experiences or advice to share? Leave your comments, questions and feedback below. Good luck!

How we review the content at LiveCareer

Our editorial team has reviewed this article for compliance with Livecareer’s editorial guidelines. It’s to ensure that our expert advice and recommendations are consistent across all our career guides and align with current CV and cover letter writing standards and trends. We’re trusted by over 10 million job seekers, supporting them on their way to finding their dream job. Each article is preceded by research and scrutiny to ensure our content responds to current market trends and demand.

About the author

Since 2005, the LiveCareer Team has been helping job seekers advance their careers. In our in-depth guides, we share insider tips and the most effective CV and cover letter writing techniques so that you can beat recruiters in the hiring game and land your next job fast. Also, make sure to check out our state-of-the-art CV and cover letter builder—professional, intuitive, and fully in line with modern HR standards. Trusted by 10 million users worldwide.

Rate this article:

Investment banking cv

Average:

Looking for a job-winning CV?

Try our cv builder for free

Our customers were hired by: